Inside Champagne’s wine investment market

- Champagne has enjoyed rising popularity as an investment in recent years, which has been reflected in its price performance.

- The Liv-ex Champagne 50 index has considerably outperformed industry benchmarks.

- While quality is important, brands and age are the most significant drivers behind its performance.

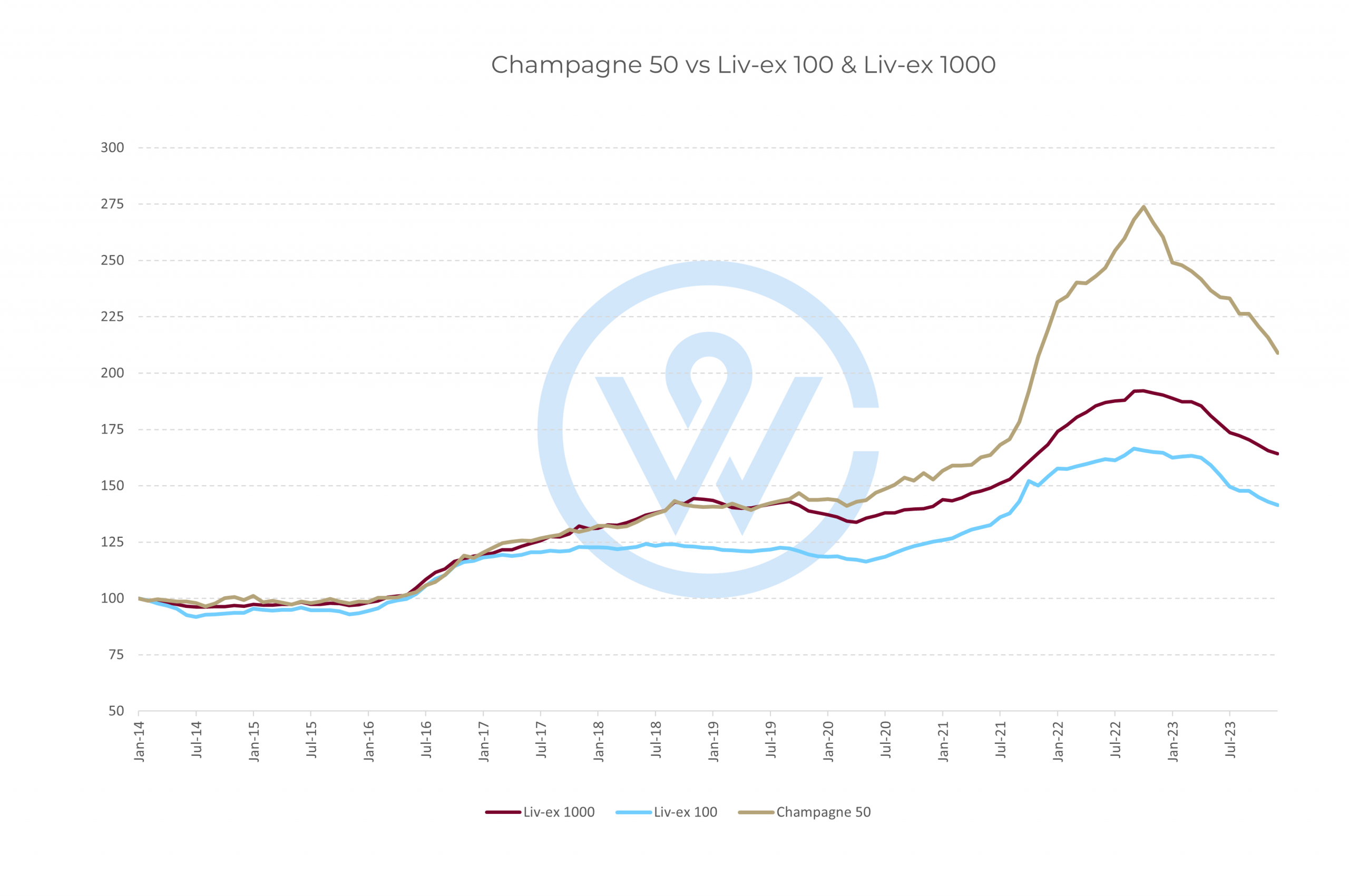

Champagne has enjoyed rising popularity as an investment in recent years, which has been reflected in its price performance. The Liv-ex Champagne 50 index, which tracks some of the most sought-after wines including Krug Vintage Brut, Bollinger La Grande Année, Dom Pérignon, Louis Roederer Cristal, and Taittinger Comtes de Champagne among others, has significantly outperformed global benchmarks. Over the last decade, the Champagne 50 index is up 108.9%, compared to 41.4% for the Liv-ex 100 and 64.3% for the broader Liv-ex 1000 index.

These numbers clearly demonstrate that Champagne is a smart addition to any diversified investment portfolio and should no longer be considered just a celebratory indulgence.

Champagne’s price performance

Much of Champagne’s remarkable performance happened between mid-2020 and the end of 2022, when the index appreciated 90.9% (May 2020 – October 2022). This period was marked by great uncertainty, from the Covid-19 pandemic, through war in Ukraine, rising inflation and recession. As the ultimate ‘luxury good’ in the fine wine market, Champagne performed particularly well and its rising prices did little to temper demand.

Since then, prices have calmed but demand remains strong. Champagne dominated the list of the top-traded wines on Liv-ex in 2023, with Louis Roederer Cristal 2015 leading the value rankings, and Dom Pérignon 2013 – by volume.

Supply and demand dynamics

Demand for Champagne has led to increases in its overall production from 50 million bottles in the 1970s to over 300 million today. Of these, Moët & Chandon contributes over 30 million bottles per year, making it the world’s largest Champagne producer.

Despite relatively healthy production volumes, the availability of vintage Champagne is limited (due to its staggering consumption market, which includes hospitality and entertainment industry buyers). This further enhances its desirability as an investment.

As it ages, its quality improves; as it is consumed, its supply decreases. This dynamic brings about an inverse supply curve – the ideal scenario for investors.

Smaller initial costs are another positive, as Champagne offers both new and experienced investors relative affordability. Although prices have moved considerably in recent years, the average case of top Champagne costs less than a case of the top wines of Bordeaux, Burgundy, California or Italy. Meanwhile, the region offers better returns.

What makes Champagne investment unique

The fine wine market has long been influenced by major critics. While critics do play a part in the evolution of Champagne prices, brands and age have proven to be more significant performance drivers.

Champagne houses that have an established and historically proven identity are already ahead of the game; however, endorsements from sources such as royal weddings, celebrities and high-visibility restaurants have paved the way for emerging cuvées.

Champagne is a more direct market than ones like Bordeaux as there are no négociants; the structure in Champagne is such that over 90% of producers are now also distributors.

Thanks to its artisanal qualities, ‘grower Champagne’ is a newly expanding sector (small estates where the brand identity is centred around the vigneron themselves). Leading this group are the likes of Jacques Selosse, Egly-Ouriet and Ulysse Collin.

An added benefit to Champagne’s appeal is its drinkability. If an investor simply cannot resist popping the cork, Champagne can be readily consumed much earlier than premium investment wines, further diminishing supply and driving prices up.

To find out more about the investment market for Champagne, read the full report here.