Key trends that shaped the fine wine market in Q3

The following article is an extract from our Q3 Fine Wine Investment report, which will be published next week.

- Ongoing inflation and interest rate hikes led to increased volatility in mainstream markets.

- The fine wine market in Q3 was a buyer’s market for two main reasons: availability of stock and falling prices creating value.

- Two of the best value La Place releases were Almaviva 2021 and Masseto 2020.

High interest rates rattle global markets

Mainstream markets experienced a turbulent third quarter, mainly due to a marked rise in borrowing costs coupled with a substantial increase of nearly 30% in oil prices. As a major input in several industries, rising prices for crude oil led to overall increase in production costs, impacting profit margins and, ultimately, reducing stock prices. These developments created a challenging landscape for stocks and bonds, with investors opting for more liquid assets like cash that tends to be a safer short-term bet. This inclination towards liquid assets illustrated the unresolved struggle between the Federal Reserve and inflation, leaving investors navigating a path marked by heightened risk and uncertainty.

Fine wine’s downturn slows

Fine wine prices fell in Q3, but their declines gradually became smaller. For instance, the Liv-ex 100 index recorded dips of 3.1% in July, 1.3% in August and 0.1% in September, showing humble signs of recovery. The broader Liv-ex 1000 index dipped 3.9% in Q3. Italian wine fared well, thanks to strong performance from Tuscany and Piedmont, as well as older Bordeaux vintages which experienced slight rebounds. Global trading activity increased suggesting that interest is there for well-priced stock.

A buyer’s market

The fine wine market in Q3 was a buyer’s market for two main reasons: availability of stock and falling prices creating value. This was particularly noticeable in regions like Champagne. Some of the top and most desirable brands, which have an impressive mid- to long-term performance saw small declines in Q3. Buyers took advantage of this opportunity and demand increased. Such is the case with Dom Pérignon 2013, which has fallen 7.1% in value since its release in January but has been the most traded wine this year. The brand’s overall trajectory is upwards, with Dom Pérignon prices rising 64% on average in the last five years, and 133% over the last decade.

Assessing the La Place de Bordeaux campaign

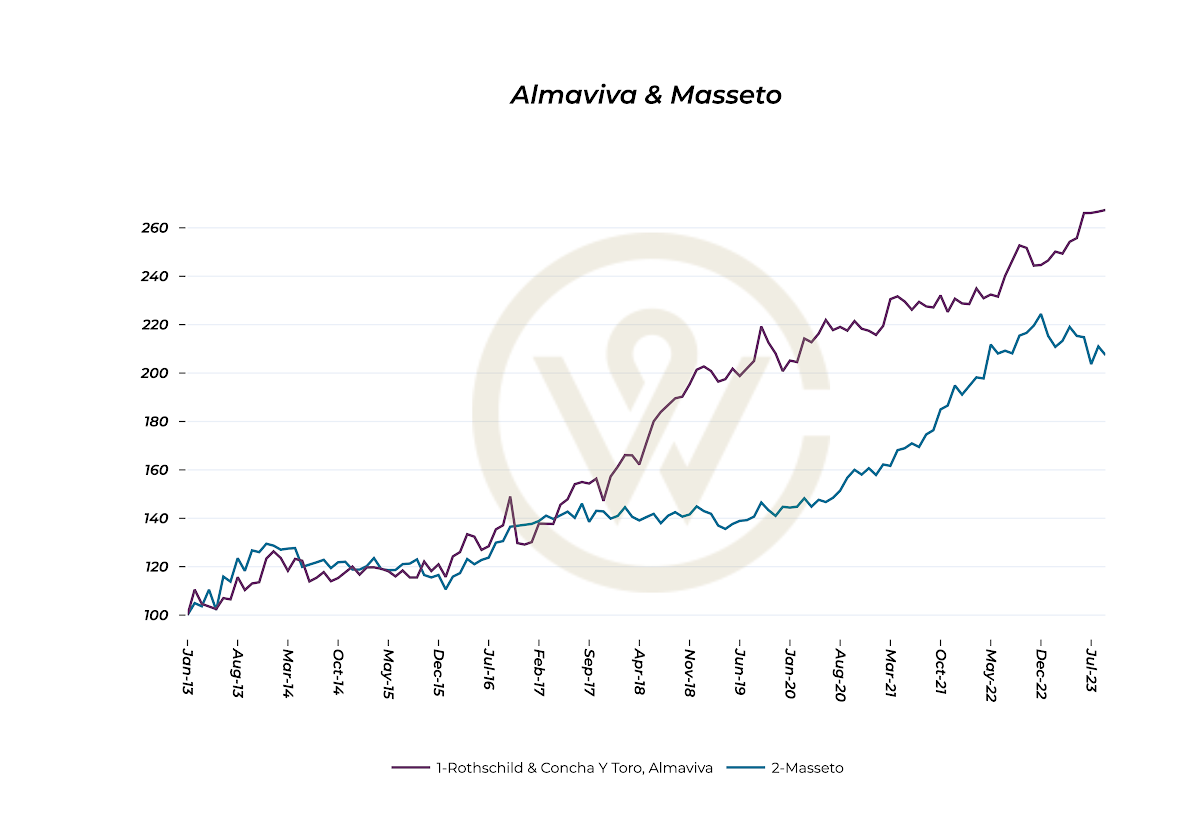

Over 110 fine wines were released through La Place de Bordeaux this September. The overall pricing strategy bore similarities to Bordeaux En Primeur earlier this year: price increases that failed to take the current market environment into account. Some critics expressed the opinion that there weren’t ‘as many hits as usual’. Two wines that stood out as good value were Almaviva 2021 and Masseto 2020; the latter immediately generated trading activity above its release price.

Over the last decade, Almaviva prices have risen on average 167%, while Masseto is up 107%.

Stay tuned – our Q3 Fine Wine Investment report will be published next week. The report contains further analysis on the best-performing and most in-demand wines, and Q4 investment outlook.