Q4 2022 | Report

Our Q4 report, analysing the trends that shaped the fine wine market over the past three months, is now available to download. The report also provides a summary of the year in fine wine and a look ahead to 2023, accounting for the macroeconomic environment and core factors such as inflation, currency moves, new releases, supply, and levels of demand.

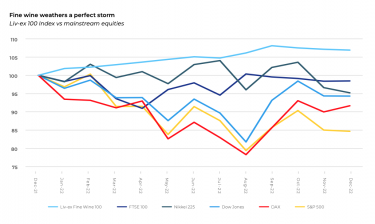

Fine wine shows remarkable resilience in 2022

The fine wine market remained bullish in the face of severe headwinds, which only started to impact its performance in the final quarter. 2022 brought a perfect storm of pandemic, war, inflation, climate change and unsteady politics, which led currencies, bonds and equities spiralling downwards. But fine wine did not experience any of the volatility that affected mainstream markets. Instead, all major fine wine indices finished the year with increases. Rare Burgundy and vintage Champagne enjoyed soaring demand and peaking prices.

What to expect in 2023

If 2022 was all about Burgundy and Champagne, 2023 is likely to see the return of more subdued market players, which offer value and quality. Stability will be a key theme in the new year as the economic outlook remains uncertain.

Although fine wine might experience a temporary drift following its bull run, many wines continue to set trading records. Among them in Q4 were some of the critics’ ‘wines of the year’ such as Talbot 2019 and Lynch Bages 2014. Bordeaux remains the market’s driving force, with heightened demand across both ‘on’ and ‘off’ vintages. But demand is also getting broader, with more wines considered investment-worthy than at any other point in history, be it grower Champagne, the Rhône, Italy, California or further afield.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by fine wine. Download our brand new report below for your summary of the past quarter in fine wine.

Q4 2022 Report

Three reasons why the Brexit deal will prevent customers from paying more for their wine.

Ever since the UK voted to leave the European Union in 2016, trade talks and negotiations between the two sides had been full of uncertainty, posturing and brinkmanship which at times made it feel like a deal was unobtainable. So, the news that a trade deal – now ratified by the UK Parliament - had been struck on Christmas Eve last year was met with welcome relief across all industry sectors on both sides of the Channel and especially by those looking to invest in wine.

1. The costly VI-1 import documentation for UK and EU wines is no longer going to be introduced in July as previously planned. Taking its place will be a straightforward Wine Import Certificate which asks for basic producer and product information. This means far less admin and fees for wine importers, which in turn means no extra costs will be passed on to customers.

2. Crucially, wines will not have to undergo lab assessment for the new Wine Import Certificate. Submitting wines for lab analysis would have caused backlogs of wines which would have created frustrating shipment delays.

3. While UK wine importers are going to have to get to grips with new processes and forms over the coming months, this is just part of the anticipated bedding-in period which will become second nature as time goes on and as new processes are established.

With the previous uncertainty around Brexit having disappeared with the end of the transition period and with 2021 looking to mirror previous years of healthy returns for fine wine, contact us to speak to one of our advisors about creating your portfolio to invest in wine.

Sign up to our newsletter to keep in the know about market developments

Subscribe to our newsletter

T: UK +44 207 060 7500T: US +1 310 310 7610 | hello@winecap.com

Registered Office: WineCap Limited, Salisbury House, London, United Kingdom, EC2M 5SQ

WineCap Limited | Company No. 08480079 | VAT No. GB174 8533 80 | AWRS No. XCAW00000119418 | WOWGR: GBOG174853300

Copyright © 2025 WineCap Limited

T: UK +44 207 060 7500 | T: US +1 310 310 7610 | hello@winecap.com

Registered Office: WineCap Limited, Salisbury House, London, United Kingdom, EC2M 5SQ

WineCap Limited | Company No. 08480079 | VAT No. GB174 8533 80 | AWRS No. XCAW00000119418 | WOWGR: GBOG174853300

Copyright © 2025 WineCap Limited