The best wine investment regions in 2024

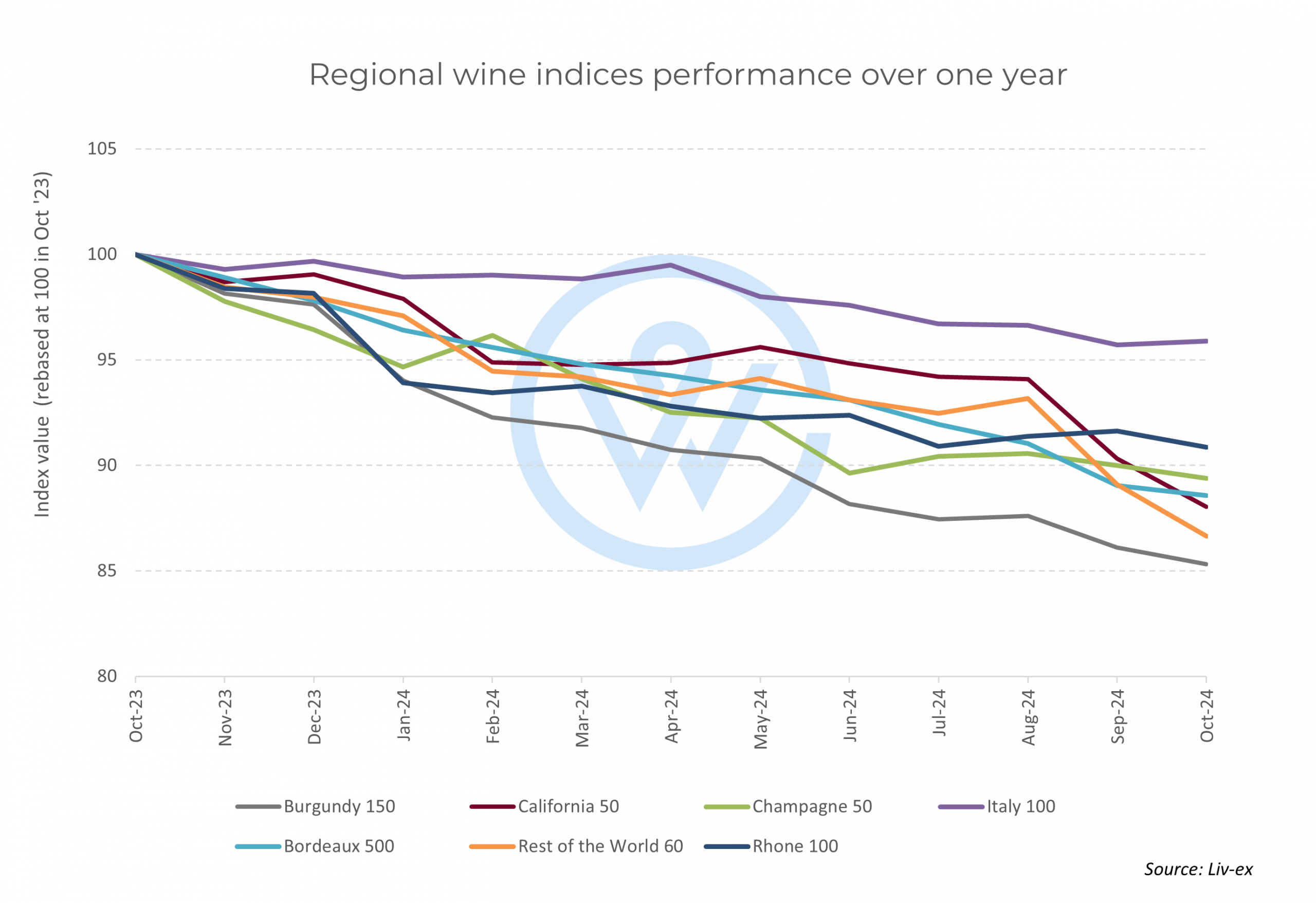

- Italy’s market performance has been the most resilient across all fine wine regions.

- Burgundy prices have fallen the most in the last year.

- Champagne is showing consistent signs of recovery.

The market downturn has affected all fine wine regions, arguably making it a great time to invest while prices are low. Today we take a deep dive into the performance of individual regions – identifying the most resilient markets, the best opportunities, and the regions offering the greatest value.

Italy: the most resilient market

Prices for Italian wine have fallen 4.1% in the past year – less than all other fine wine regions. By comparison, fine wine prices have fallen 11.6% on average, according to the Liv-ex 1000 index.

Italy’s secondary market has been stimulated by high-scoring releases, like Sassicaia and Ornellaia 2021. Beyond the Super Tuscans, which are some of the most liquid wines, the country continues to offer diversity, stable performance and relative value.

Some of the best-performing wine brands in the last year are Italian – all with an average price under £1,300 per 12×75, like Antinori Brunello di Montalcino Vigna Ferrovia Riserva (£1,267, +38%).

Other examples under £1,000 per case include Le Chiuse Brunello di Montalcino (+28%), Gaja Rossj-Bass (+27%), and Speri Amarone della Valpolicella Classico Monte Sant Urbano (+25%).

Burgundy takes a hit

Burgundy’s meteoric rise over the past two decades made it a beacon for collectors, but its steep growth left it vulnerable to corrections. In the past year, Burgundy prices have fallen 14.7%, making it the hardest-hit region. This downturn has released more stock into the market, creating opportunities for investors to access wines in a region often defined by scarcity and exclusivity.

Wines experiencing the largest declines include include Domaine Jacques Prieur Meursault Santenots Premier Cru (-41%), Domaine Arnoux-Lachaux Nuits-Saint-Georges (-35%), and Domaine Rene Engel Clos de Vougeot Grand Cru (-28%). For new entrants, these price drops offer a rare chance to acquire prestigious labels at relatively lower costs.

Champagne: on the road to recovery

Champagne has changed its trajectory over the last year: from a fast faller like Burgundy to more consistency and stability. While prices are down 10.6% on average, the dips over the last few months have been smaller than 0.6%. The index also rose in February and August this year, driven by steady demand.

Some of the region’s most popular labels have become more accessible for buyers like Dom Perignon Rose (-14%), Philipponnat Clos des Goisses (-13%) and Krug Clos du Mesnil (-12%).

Meanwhile, the best performers have been Taittinger Brut Millesime (+29%) and Ruinart Dom Ruinart Blanc de Blancs (+28%), which has largely been driven by older vintages such as the 1995, 1996 and 1998.

The fine wine market in 2024 reflects a unique moment of transition. Italy’s resilience, Burgundy’s price corrections, and Champagne’s recovery illustrate a diverse set of opportunities for investors. With prices across the board at lower levels, this could be an ideal time to diversify portfolios with high-quality wines from these regions, anticipating long-term growth as the market stabilises.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.