What is a market dip, and how can fine wine investors take advantage?

- A market dip is a temporary decline in prices, caused by economic or market-specific factors.

- Buying the dip is advised when the underlying market fundamentals are favourable.

- This is arguably the best time to invest in fine wine in a decade.

A market dip is a temporary drop in prices. This is often caused by economic or market-specific factors. In the fine wine market, these dips are less frequent and less volatile compared to traditional financial markets like stocks or bonds. While the fine wine market has been bearish three times since the turn of the century, global mainstream markets have experienced many more significant crashes.

However, when a dip does occur, and provided that the fundamentals are strong, it can present a unique opportunity for buyers. Investors can enter the market, adjust their allocations or expand their portfolios with high-value brands and rare vintages at discounted prices. Sellers may look to liquidate their stock, offering rare and premium wines from regions like Bordeaux, Burgundy, and Champagne at more attractive prices.

Currently, the fine wine market is benefitting buyers. While the temporary drop in prices might raise concerns on the surface, those who adopt a long-term, strategic approach can reap significant rewards by buying the dip.

Buying the dip when the fundamentals are strong

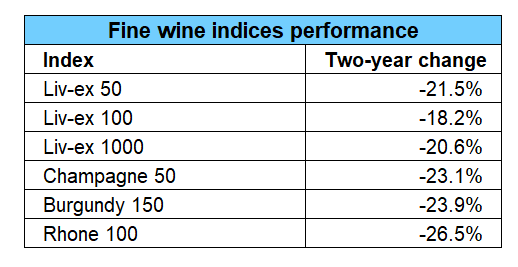

According to Sir John Templeton, the best time to invest is during ‘points of maximum pessimism’. With fine wine indices down over 20% from their 2022 peaks, this moment presents one of the best opportunities to buy in the last decade.

Fine wine fundamentals remain intact: wines improve with age, and become rarer over time as bottles are consumed. The market’s appetite for older vintages is still strong, and regions like Burgundy, Bordeaux and Champagne continue to break pricing records at auction.

Current macroeconomic environment and its impact

The global economy is currently facing several challenges – rising inflation, high interest rates, and geopolitical tensions, all of which have contributed to the recent dip in fine wine prices.

Despite these macroeconomic factors, fine wine remains less volatile than traditional markets. During times of economic uncertainty, fine wine’s tangible nature and intrinsic value have helped it weather storms better than more speculative assets like equities or cryptocurrencies.

Additionally, the growing demand for luxury goods continues to support the fine wine market. This demand will likely drive the next phase of growth once global economic conditions stabilise.

Historical fine wine market rebounds

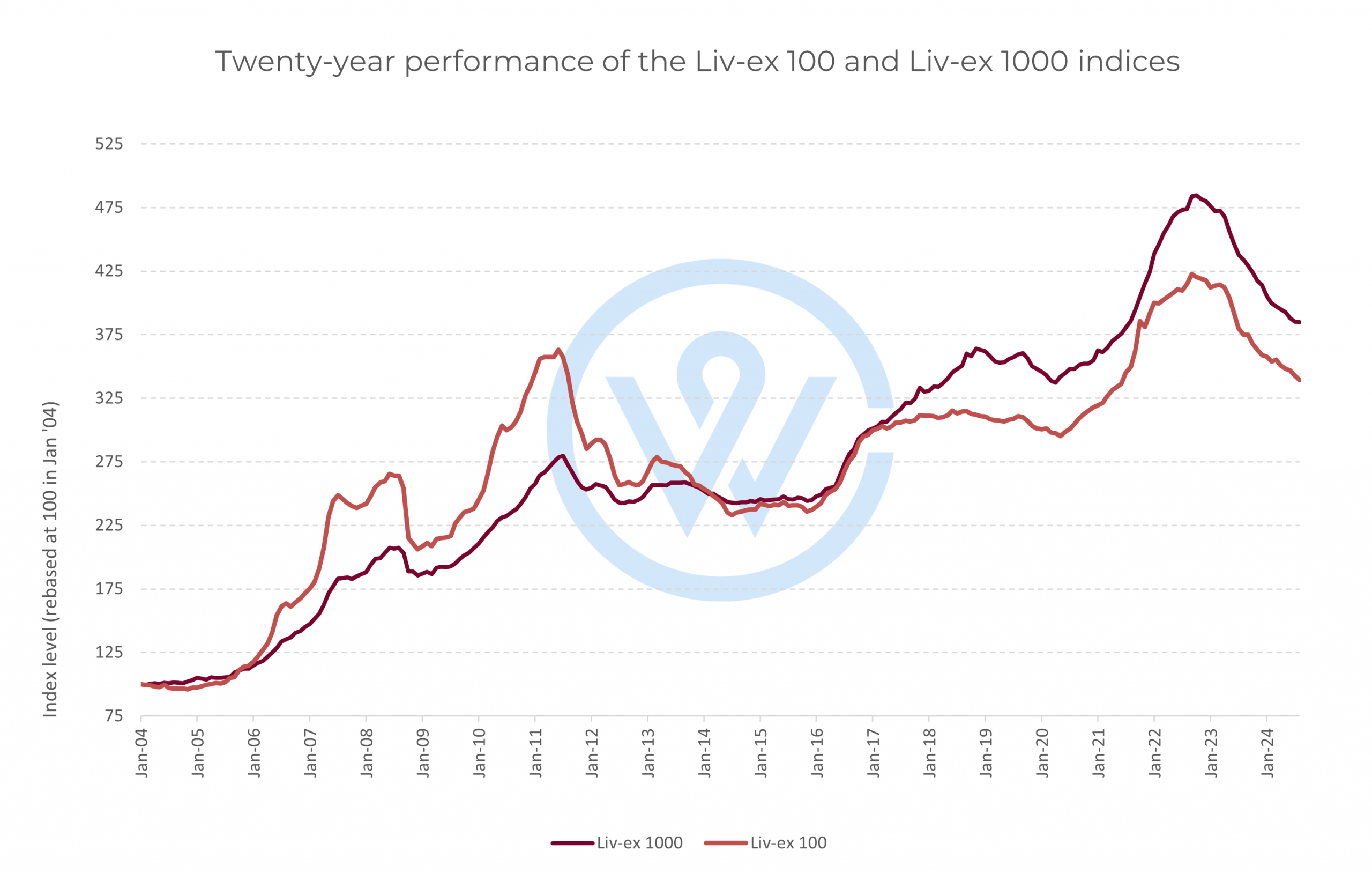

Another reason for confidence is that the fine wine market has consistently rebounded after periods of economic downturn. During the 2008 global financial crisis, the Liv-ex 100 index fell by 25% but had risen over 60% by mid-2011.

Similarly, Bordeaux’s peak in 2011 was followed by Burgundy’s rise, showing that demand for fine wine remains strong even if it shifts on a regional basis. This is why diversity is key.

The market is no longer dominated solely by top Bordeaux, and spreading your allocations across key wines and vintages can balance an investment portfolio and maximise returns.

How to take advantage of the dip in the fine wine market

For investors looking to capitalise on the current market dip, the strategy is clear: buy low and hold for the long term.

Focus on proven performers: Wines from top regions like Bordeaux, Burgundy, Italy and Champagne have historically demonstrated resilience. Investing in top vintages and estates offers a measure of security.

Take advantage of fear-driven selling: As some sellers look to exit the market prematurely, investors can acquire undervalued wines with strong growth potential.

Diversify your portfolio: Spread your investment across different regions, producers, and vintages to mitigate risk and maximise returns.

Get in touch to discuss your allocations or to start building your fine wine collection. Schedule a consultation.