Fine wine market trends amid economic shifts in Q1 2024

The following article is an extract from our Q1 2024 Fine Wine Report which will be published in full later this week.

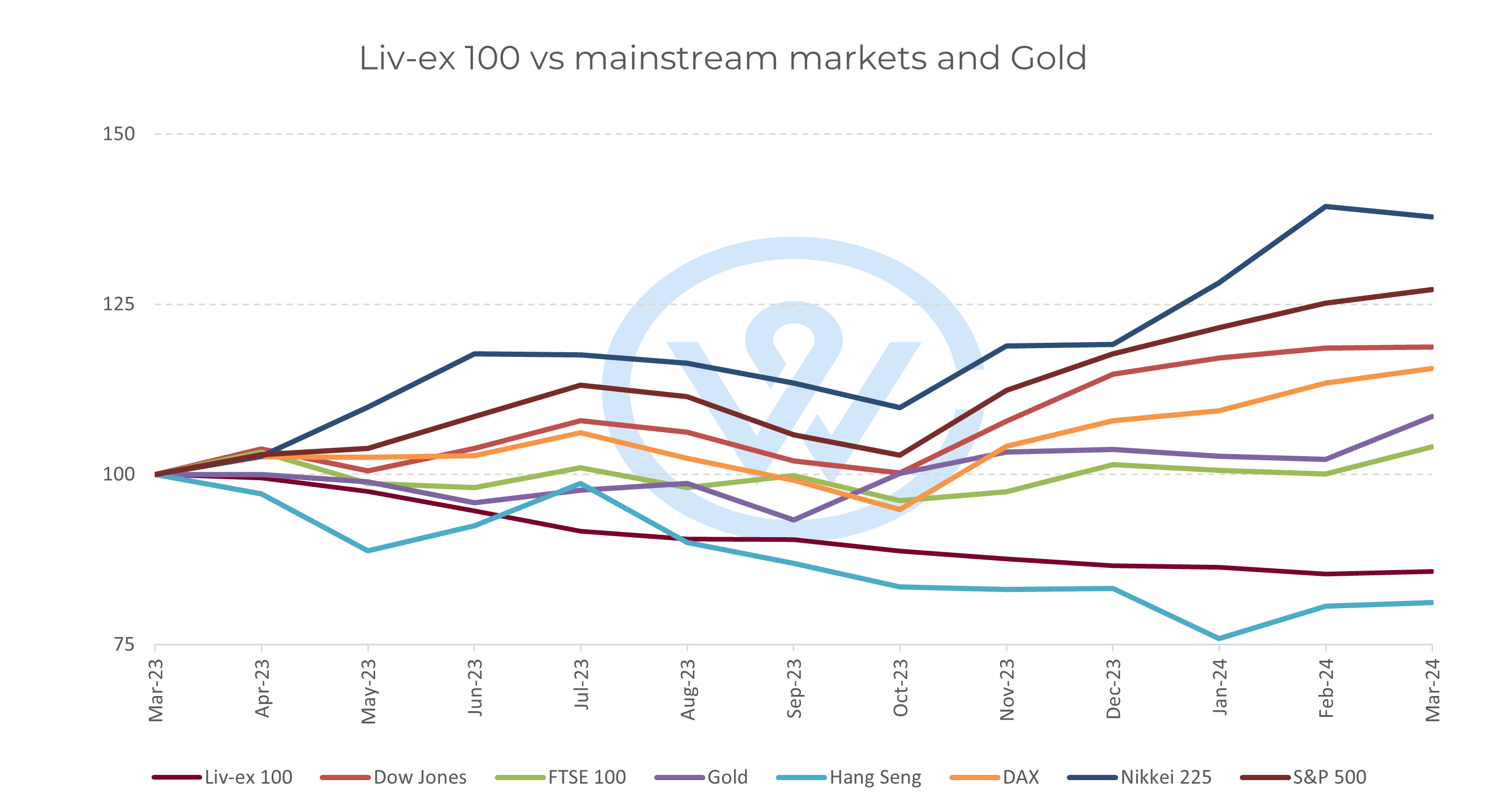

- The industry benchmark Liv-ex 100 index fell 1% in Q1 2024, a milder decline than the 4.2% dip at the end of last year.

- Bond and equity markets rallied in anticipation of interest rate cuts by major central banks.

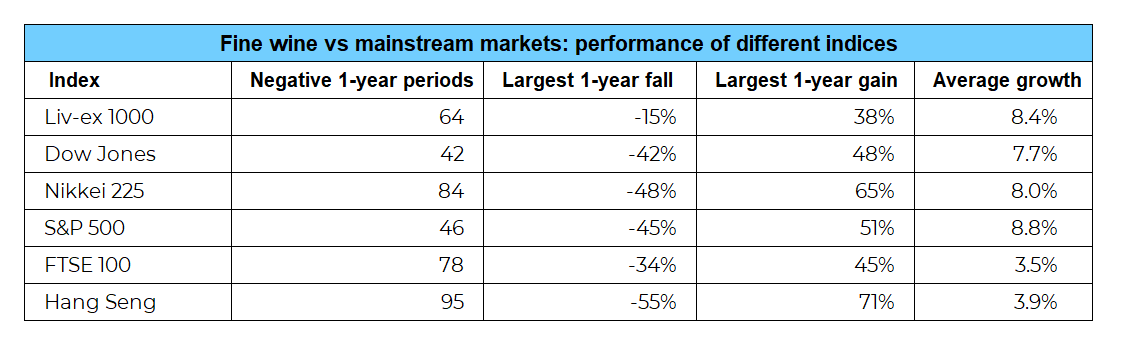

- Over the past twenty years, the Liv-ex 1000’s most significant year-on-year dip was only 15%, less severe than that of major stock indices like the S&P 500 (-45%).

After a challenging start to the year, the global economy is showing signs of resilience and potential growth. As we moved past the first quarter of 2024, both bond and equity markets rallied in anticipation of interest rate cuts by major central banks. Notably, sectors like the fine wine market are expected to benefit from these shifts, although the impact has not yet materialised.

The fine wine market in Q1 2024

The industry benchmark, Liv-ex 100 index, saw a modest decline of 1% in Q1 2024, an improvement from the 4.2% dip observed at the end of the previous year. This index experienced a slight drop of 0.3% in January and 1.1% in February but recovered in March with a 0.4% increase, marking its first rise in twelve months. Influential movers included Promontory and Dominus from Napa Valley, Super Tuscan Sassicaia, and Clos des Papes Châteauneuf-du-Pape. Despite this recovery, the fine wine market’s performance still lags behind mainstream financial markets.

Comparing mainstream markets

Mainstream indices such as the Nikkei 225 and the S&P 500 have shown remarkable strength over the past year. Their annual growth from March 2023 to March 2024 ranks in the top 10% of year-on-year periods this century.

However, bond and equity markets experienced heightened volatility at the beginning of the year, due to geopolitical risks like the Middle East conflict and ongoing uncertainty around interest rates. This confluence of factors boosted the safe-haven asset Gold which has extended its run on buying momentum.

A decade of the Liv-ex 1000 index

Celebrating ten years since its official launch in January 2014, the Liv-ex 1000 index provides two decades of insight into fine wine prices, encompassing a wide range of regions including Bordeaux, Burgundy, Champagne, the Rhône, Italy, and the rest of the world (Spain, Portugal, the USA, and Australia).

Over the past twenty years, while the Liv-ex 1000 has seen 64 year-on-year declines, its most significant drop was only 15%, considerably less severe than that of major stock indices like the S&P 500, which once fell by 45%.

On the upside, the Liv-ex 1000’s best annual performance showed gains of 38%, comparable to those of major indices like the FTSE 100 and the Dow Jones, and its average growth rate of 8.4% is higher than many mainstream markets, only trailing behind the S&P 500.

As the global markets navigate through turbulent waters, the nuanced performance of the fine wine sector, detailed in our comprehensive Q1 2024 report, continues to offer valuable perspectives on both the challenges and opportunities that lie ahead.

Stay tuned for the full report later this week.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.