The state of the fine wine market so far in 2024

- Fine wine remains a buyer’s market in 2024.

- Burgundy prices have fallen the most, while Italy has been the most resilient region.

- Some wines have outperformed the market, such as L’Église-Clinet 2012.

The fine wine market remains a buyer’s market in 2024. All fine wine regions have experienced declines, with prices for Burgundy, Bordeaux, and Champagne falling the most.

Still, some wine brands have outperformed the market by far – such as Henri Boillot Chevalier-Montrachet Grand Cru, which is up 23% since the beginning of the year.

Regional wine performance so far in 2024

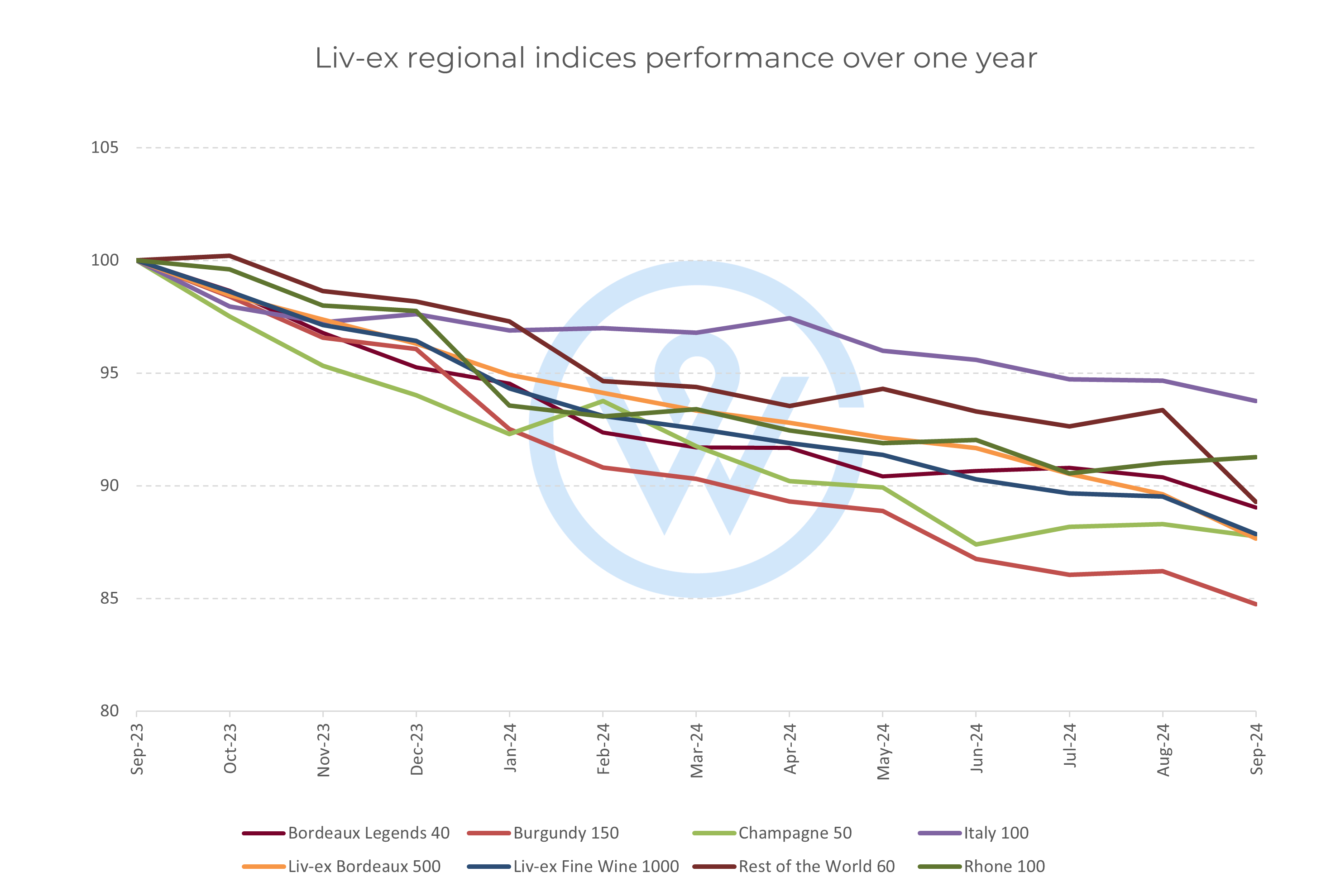

The fine wine market’s downturn has continued into 2024. The broadest measure of the market, the Liv-ex 1000 index, is down 4.9% year-to-date. Within it, Burgundy (-7.0%) and the Rest of the World (-4.8%) sub-indices have fallen the most.

The Champagne 50 index is also down 4.5%. However, the index rose 0.9% last month, buoyed by Dom Pérignon 2006 and 2012, Louis Roederer Cristal Rosé 2008 and various vintages of Pol Roger’s Cuvée Sir Winston Churchill.

As we have previously explored, Italy has been the most resilient fine wine region, down 2.3% year-to-date. Its performance has been stabilised by brands from Piedmont, specifically Barolo and Barbaresco.

The Rhône 100 index, which has been the perennial underperformer over the long term, has also experienced lesser declines this year, falling just 3.2%. Outside the Liv-ex 1000 index, the California 50 is down 3.8%.

The biggest risers this year

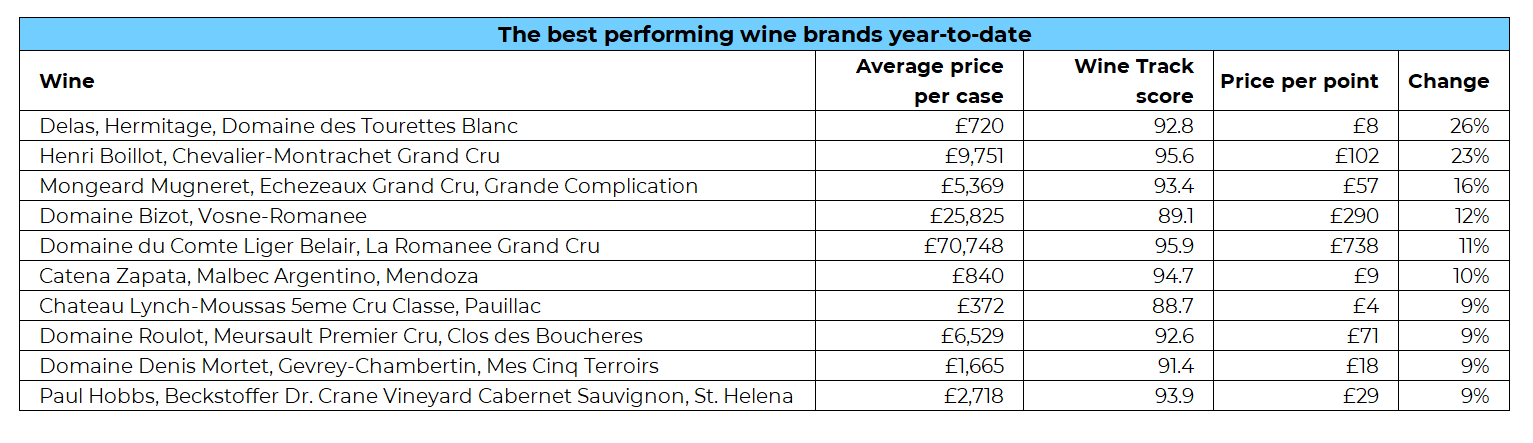

Despite broader market uncertainties, some brands have risen by close to 30% in value since the beginning of the year (as of August 1st).

With an average case price of £720, Delas Hermitage Domaine des Tourettes Blanc is up 26% this year. It has been followed by a high-profile Burgundy – Henri Boillot Chevalier-Montrachet Grand Cru, which has risen 23%.

The most expensive wine on the rankings, Domaine du Comte Liger-Belair La Romanée Grand Cru, has enjoyed an 11% rise.

The best performing wines

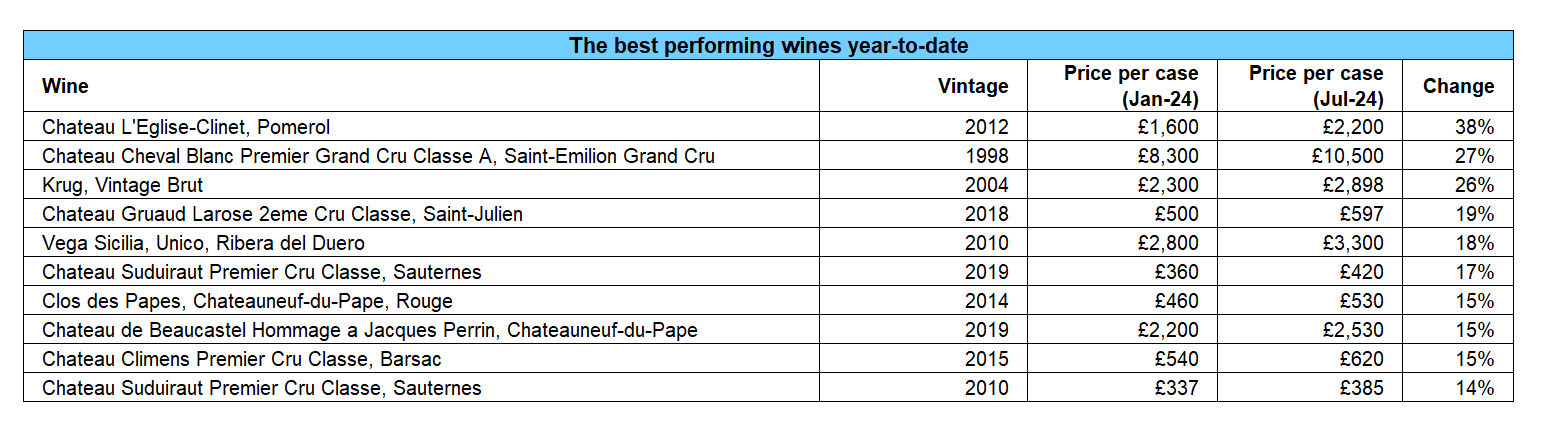

When it comes to the best performing individual wines, Bordeaux leads the way with L’Église-Clinet 2012, up an impressive 38%. It has been followed by Cheval Blanc 1998, up 27%.

Another top Bordeaux comes fourth – Gruaud Larose 2018 (19%). Sweet Bordeaux also features in the table with two vintages from Suduiraut, 2019 and 2010, and Climens 2015.

Meanwhile, Champagne’s best performer is the ‘gorgeous’ (AG 98 points) Krug 2004, up 26%.

While the fine wine market has continued to face declines across most regions in 2024, presenting great opportunities for lower-than-average prices, some wines have shown remarkable resilience. Even in a buyer’s market, excellence prevails.

For more on the state of the fine wine market, read our latest quarterly report.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.