Bordeaux En Primeur 2023: under pressure

- Bordeaux 2023 largely met trade expectations for reduced pricing but only some releases have stood out as offering fantastic value.

- Price cuts slowed towards the end of the campaign, from 27.4% average discount in week one, to 23.3% in week four.

- Bordeaux’s ability to adapt does not only matter for its short-term sales but also for its long-term relevance in a highly competitive market.

Over the last month, our news coverage centered around the ongoing Bordeaux 2023 En Primeur campaign, examining critic scores and the investment potential of the new releases.

Prior to the start of the campaign, Bordeaux châteaux faced considerable pressure from the trade to reduce release prices. Price cuts of around 30% were expected. In some cases, these expectations were met, with reductions of up to 40%.

Now that the campaign is coming to a close, we weigh its success, considering the current state of Bordeaux’s investment market.

En Primeur 2023 – back in vogue?

Critics of En Primeur contend that the system no longer meets buyer expectations, and the 2023 vintage wanted to rise to the challenge of defying the norm.

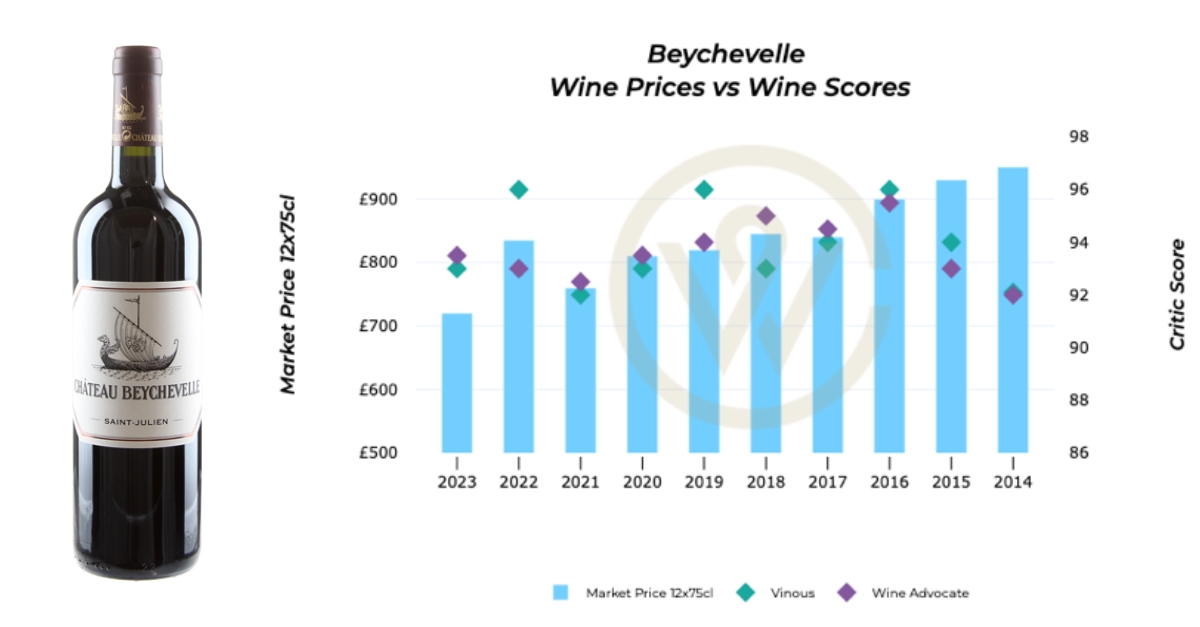

Partially it did. Wines like Lafite Rothschild, Carruades de Lafite, Mouton Rothschild, Petit Mouton, Beychevelle, Cheval Blanc and Haut-Brion delivered value and were met with high demand.

Liv-ex reported immediate trades on its exchange for some of the releases. A developing secondary market is a positive sign for investors, although both Lafite Rothschild and Mouton Rothschild 2023 changed hands below their opening levels.

According to Liv-ex, ‘it is clear there continues to be a market for Bordeaux En Primeur at the right price. What that price is, is perhaps less clear and will not always be agreed upon’.

The En Primeur golden rule

For investors, an En Primeur release needs to be the most affordable wine among vintages with comparable scores to make sense. Where that isn’t the case, one should be cautious when buying.

‘Our golden rule is the En Primeur price is the cheapest you can get. You can’t get anything cheaper. Generally speaking, it’s reasonably successful, not to say 100% successful, and then the price goes up.’ – Philippe Blanc, Château Beychevelle

‘En Primeur should be forever the lowest price you can find in your bottle. If you purchase later, it’s going to be more difficult to find and it’s going to be more expensive.’ – Pierre-Olivier Clouet, Château Cheval Blanc

The price decrease trajectory

The average price reduction among the top wines released in the first week of the campaign was 27.4%, going as low as 40% discount on the previous year.

In the fourth week of the campaign, this trajectory of offers slowed down. The average discount was reduced to 23.2%, the most significant being Château La Fleur-Pétrus 2023, down 33.6%, and the least significant, Beychevelle (-11.1%).

However, even though Beychevelle has seen one of the smallest discounts, it has still been one of the best value releases this campaign.

The Bordeaux market slowdown

The pressure to reduce release pricing was largely owing to the current market environment.

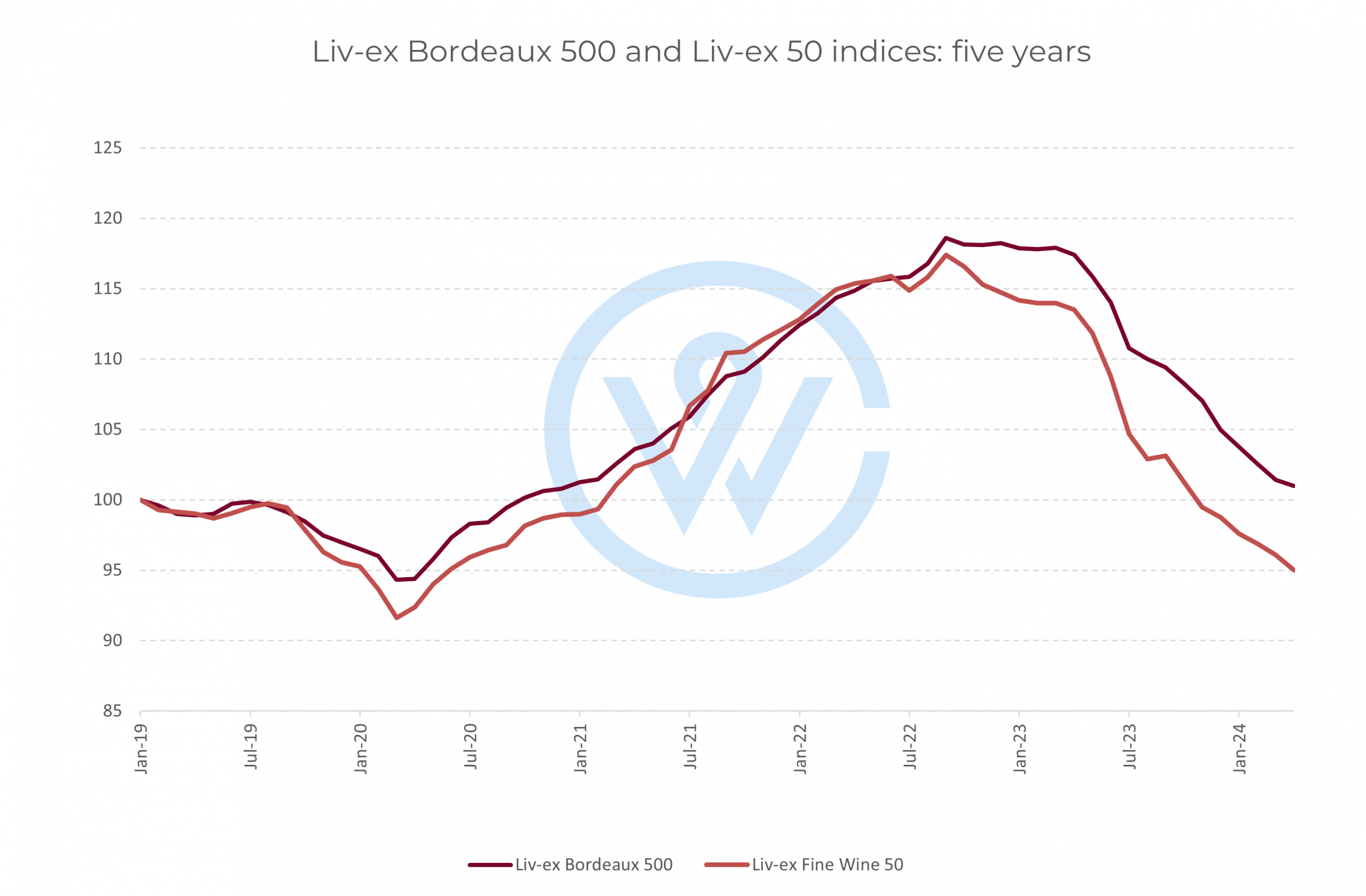

Over the past two years, Bordeaux prices are down 12%. Over the past five years, Bordeaux is one of the slowest growing markets, up 2.1%, considerably lagging behind Burgundy (25.2%), Italy (31.2%) and Champagne (45.5%).

The market for top Bordeaux has suffered the most. First Growth prices are down 17.3% in the last two years, and 3.7% in the last five years.

The region is also losing market share to its contenders. In 2023, Bordeaux accounted for 40% of the trade by value on Liv-ex compared to 60% in 2018.

This is further exacerbated by slowing demand. Liv-ex noted that today ‘there is more than three times as much Bordeaux for sale than the fine wine market is looking to absorb’.

The need to adapt

The 2023 En Primeur campaign has unfolded under the shadow of mounting pressure for Bordeaux to realign with market demands. The campaign highlighted the critical balance Bordeaux must maintain: offering wines at attractive prices for everyone in the chain.

Successful examples from this year’s campaign, where price cuts coincided with high demand, underscore the potential for Bordeaux to adapt. However, the slower reduction rates towards the campaign’s end and varied responses from buyers reflect the ongoing debate about the optimal pricing strategy.

Ultimately, as Bordeaux grapples with these challenges, the 2023 En Primeur has underscored the importance of responsiveness to market dynamics. The region’s ability to adjust will not only determine its short-term sales but also its long-term relevance in a highly competitive and ever-evolving global wine market.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.