Inside the USA’s wine investment market

The following article is an extract from our USA regional wine investment report.

- Today, the USA is one of the key fine wine investment regions.

- Its share of secondary market trade has risen from 0.1% in 2010 to around 8% this year.

- Demand has been stimulated by a string of good vintages in the past decade, high critic scores, and expanding distribution.

Today, the USA is one of the key fine wine investment regions. Its share of secondary market trade has risen from 0.1% in 2010 to about 8% this year, and an increasing number of previously overlooked wineries are now showing investment-worthy returns.

Inside the USA’s investment market

California has long been the driver behind the USA’s ever-growing presence in the fine wine investment landscape, accounting for roughly 99% of the country’s secondary market trade. Buying demand has been largely UK and US-driven and centred around the top names: Screaming Eagle, Opus One, Dominus, Harlan Estate, Promontory, and Scarecrow.

Price differentials

California is the second-most-expensive fine wine region after Burgundy, based on the average price of its leading estates. However, there are big differences in pricing between the region’s top names.

At the time of writing, the average case price of Screaming Eagle Cabernet Sauvignon is £39,117, compared to £7,399 for Promontory, £3,764 for Opus One, £2,773 for Dominus, and £2,719 for Ridge Monte Bello. To explore average trade prices, visit our indexing tool Wine Track.

Price performance

Prices for Californian fine wines have risen slowly and steadily. Over the last 15 years, the Liv-ex California 50 index which tracks the price movements of the last 10 physical vintages across five of the most traded brands (Dominus, Opus One, Harlan, Ridge, and Screaming Eagle) has outperformed both the Liv-ex 100 and Liv-ex 1000 indices. The California 50 is up 166.2%, compared to 71.6% for the Liv-ex 100 and 116.6% for the Liv-ex 1000. Moreover, over the long and short term, California has fared better than Bordeaux as an investment, yielding higher returns.

The best brands for investment

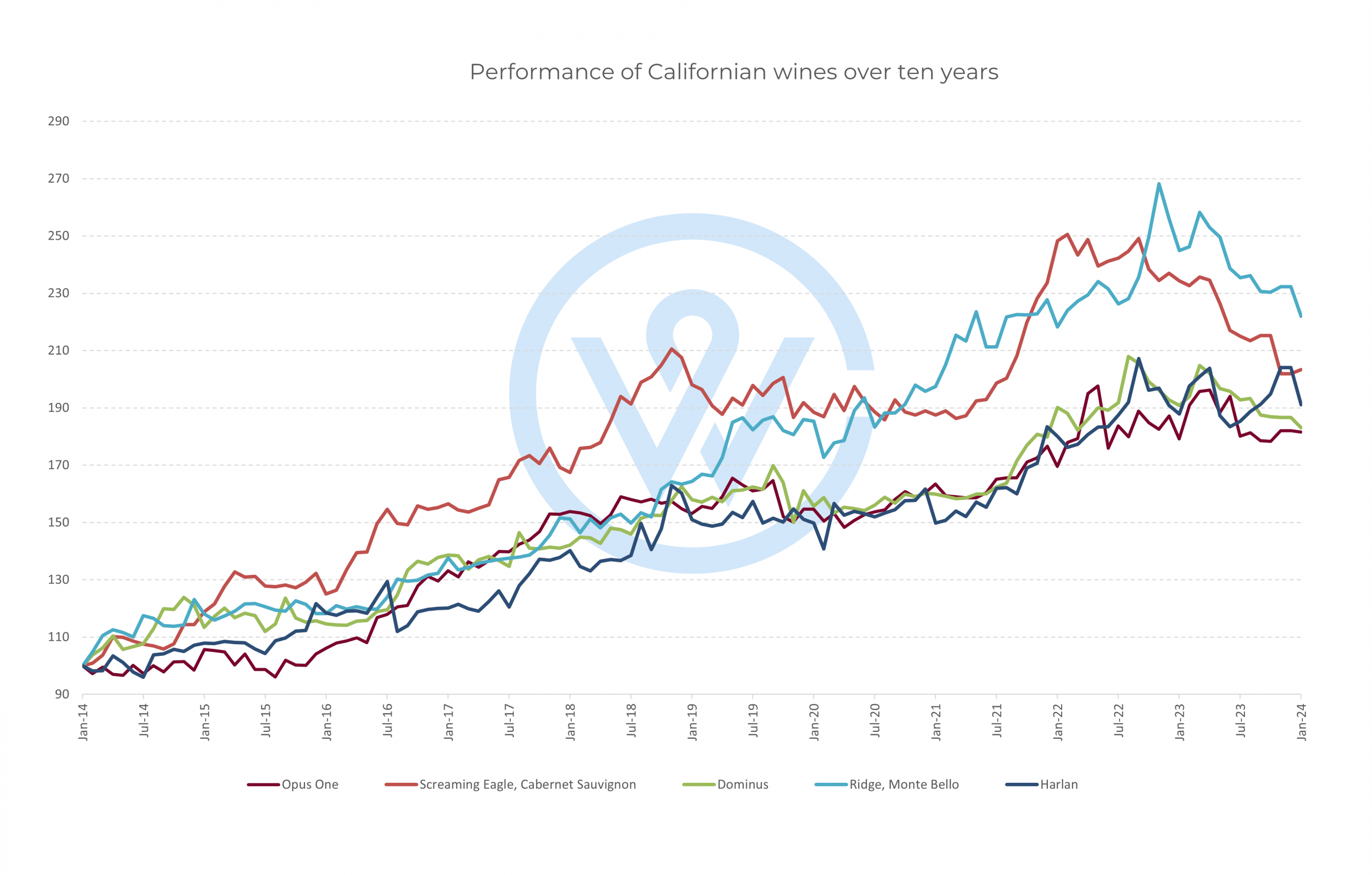

Among the most popular labels, Ridge Monte Bello has been the best-performing Californian wine, up 121.9% in the last decade. It has been followed by Screaming Eagle Cabernet Sauvignon with a 103.3% rise and Harlan, up 91.1%. All the wines in the chart below have risen over 80% in the last decade.

However, other producers beyond the most traded names have also been making waves. Caymus Cabernet Sauvignon has risen an impressive 154.8%, while Dunn Howell Mountain Cabernet Sauvignon is up 137.5% in the last decade. This data suggests that there is a significant number of American wines beyond the most popular names that can deliver healthy investment returns.

California: A 100-point region

Price performance has been influenced by ‘cult’ status and vintage quality. California regularly tops critic rankings as the region with the most 100-point wines. Relatively consistent climate has led to less vintage variation than in other dominant fine-wine producing regions. Major critic publications like Wine Advocate and Wine Enthusiast highlight 2001, 2007, 2012, 2013, 2015, 2016, 2018, 2019, and 2021 as particularly good.

To find out more about the investment market for US wines, read the full report here.