Which Bordeaux First Growth has the lowest price per point?

- The price-per-point metric allows for a comparison of wines based on their market price and perceived quality.

- This article examines the prices per point of the most liquid group of wines – the Bordeaux First Growths.

- It also looks at their historic market performances.

Price per point is an indicator of value; it is calculated by dividing the average case price of a given wine by its average critic score. For some wines, prices and points line up. Typically, a 100-point wine will cost more than a 95-point one, though not always. The price-per-point metric allows for a comparison of wines based on both their market price and perceived quality, offering a nuanced view of their value.

Today we examine the price-per-point ratios of the most liquid and popular group of wines – the Bordeaux First Growths. Which Grand Vin has the lowest price per point and thus offers the best value as a brand?

First Growths – price per point

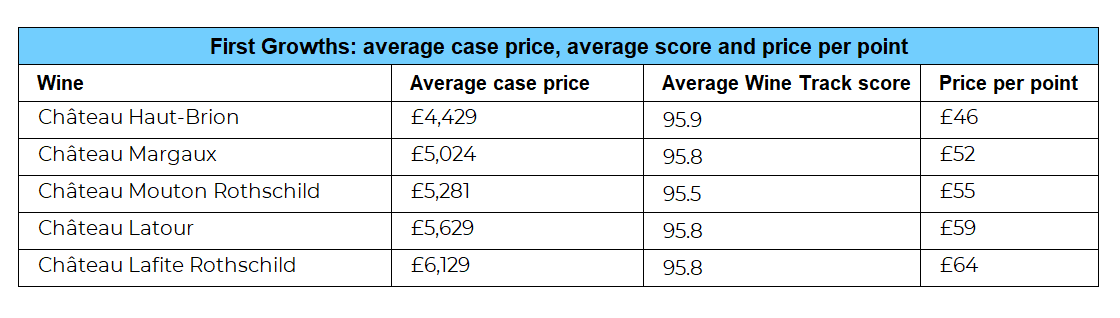

An average case price of £4,429 makes Château Haut-Brion the most affordable of the First Growths. Meanwhile, it has the highest average Wine Track score of 95.9 points. While there is divergence in prices and scores on a vintage-specific level, Château Haut-Brion has the lowest price per point among the First Growths overall.

At the other end of the spectrum, Château Lafite Rothschild has the highest price per point of £64, owing to the highest average case price of £6,129 and a Wine Track score of 95.8.

What does this mean for the wines’ performance?

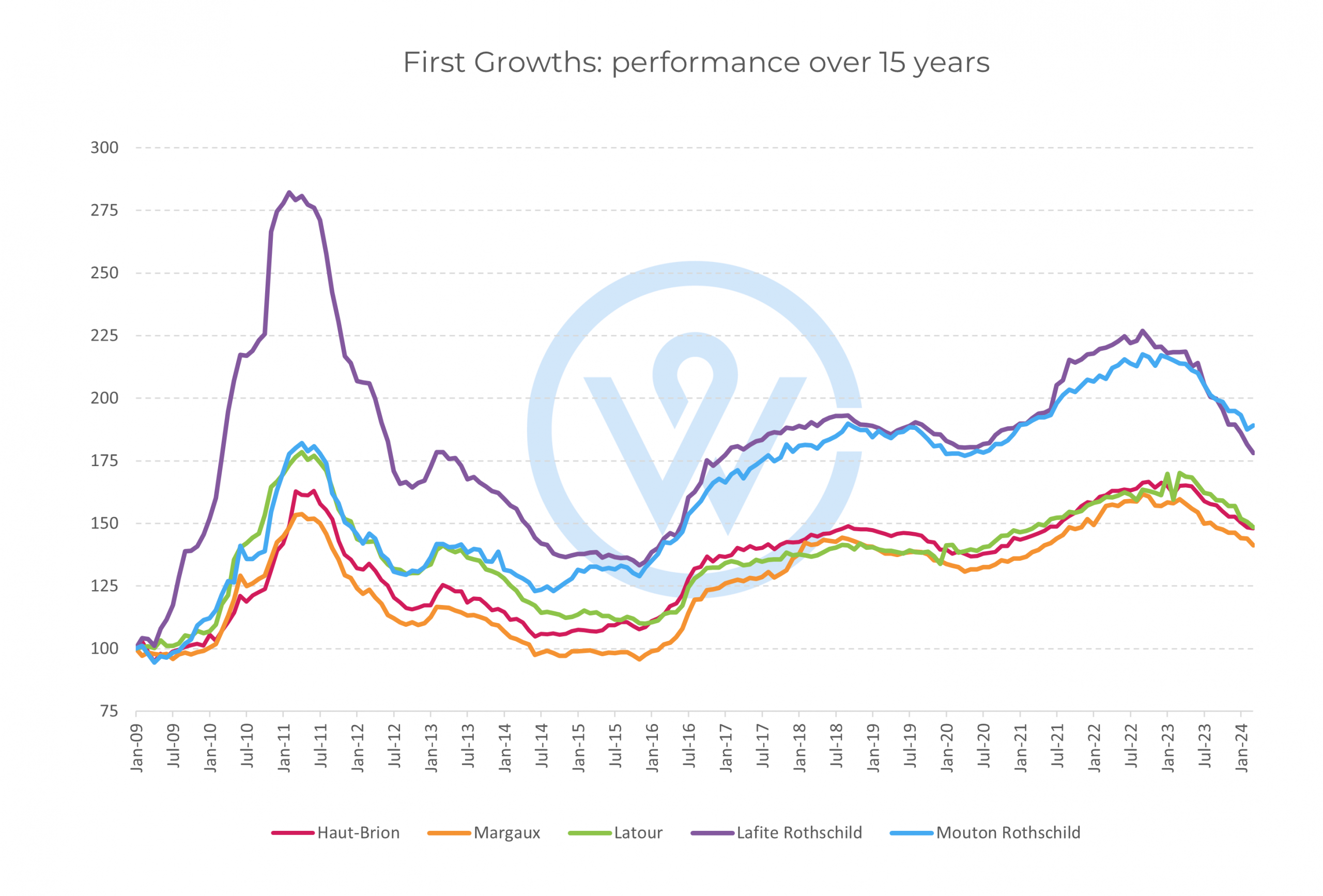

Historically, the First Growths have followed a similar trajectory of highs and lows. They all peaked during the China-led bull market (H1 2011) and experienced a subsequent downfall. Prices started to rise again following the Brexit referendum and have since largely maintained their level. They have fallen in the last year in line with the broader market (the Liv-ex 50 which tracks the First Growths is down 15.3% over one year – the same as the broadest measure, the Liv-ex 1000 index).

Of the five First Growths, Lafite has risen the most, with our index peaking in February 2011. Recently, however, it has been the biggest faller, dipping 19% in the last year. Haut-Brion, which has been a more modest performer without delivering the same heights, has dipped the least of the First Growths (10%) during the same period. With a more stable market performance, Haut-Brion offers further opportunities for investors and collectors where the price per point remains comparatively low.

Wines that offer value perform the best

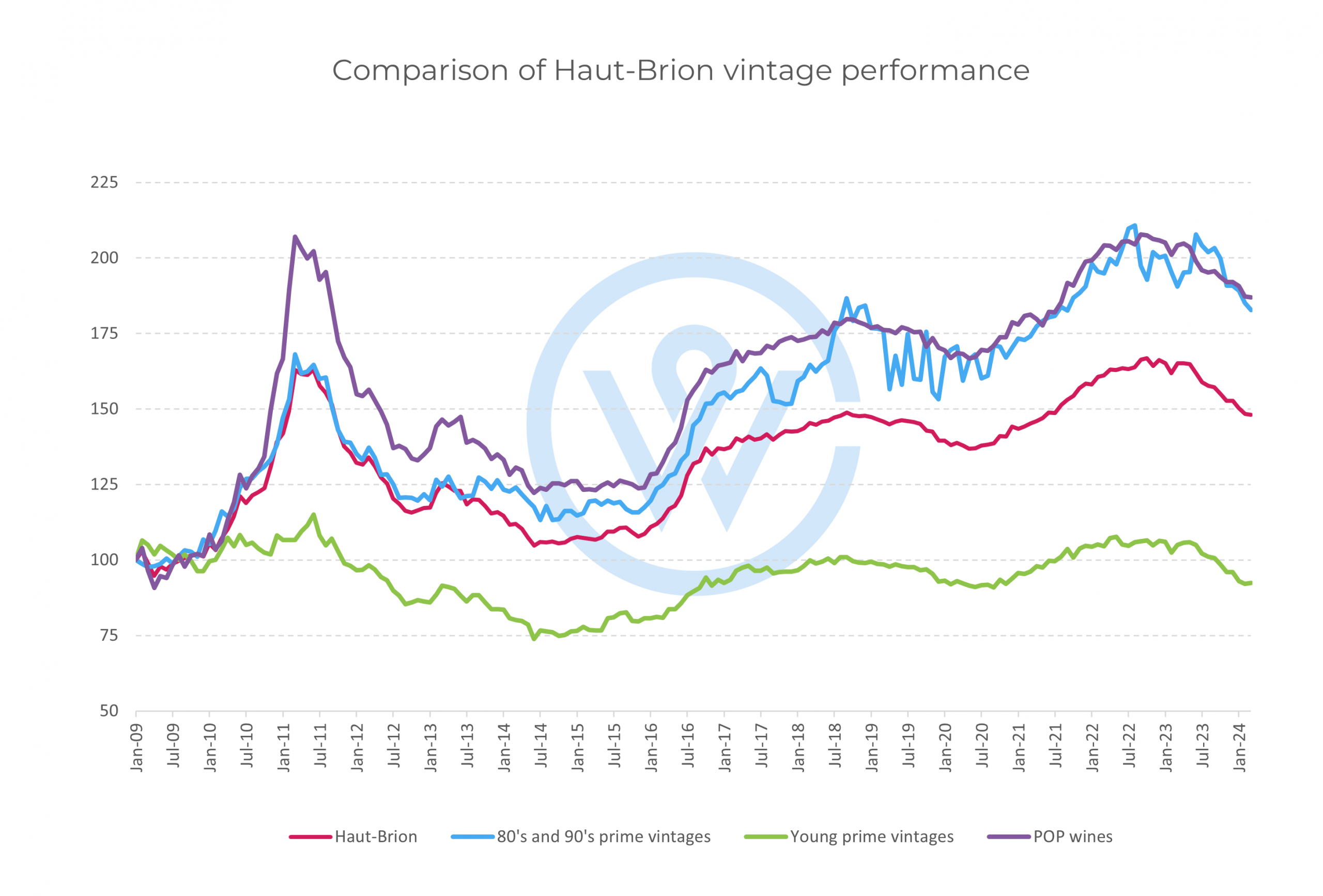

In the case of Haut-Brion, value plays an important role in market performance. POP wines (those with a lower price per point) have outperformed the rest over 15 years. These include vintages 2002, 2004, 2006, 2007, 2008, 2011, 2012, 2013, 2014, 2017 and 2019 (the only prime vintage among the POP wines).

The second-best-performing index comprises older ‘prime’ vintages – wines with high scores pre-2000. However, this index has shown higher volatility due to the limited availability and trading volumes of these wines.

The index comprising younger ‘on’ vintages like 2015, 2016, 2018 and 2020 has underperformed the rest of the pack. However, these wines have also had less time in the market and their evolution is yet to be seen.

In conclusion, looking at price per point gives an indication of value and quality. However, historic market performance is telling for investors looking for stability or higher risk and potentially higher rewards.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.