Green shoots in the fine wine market

- Green shoots are starting to appear in the fine wine market after a year of consistent declines.

- On a regional level, prices for Champagne and Italian wine rose last month.

- We highlight individual brands that have shown positive performances over the last three months.

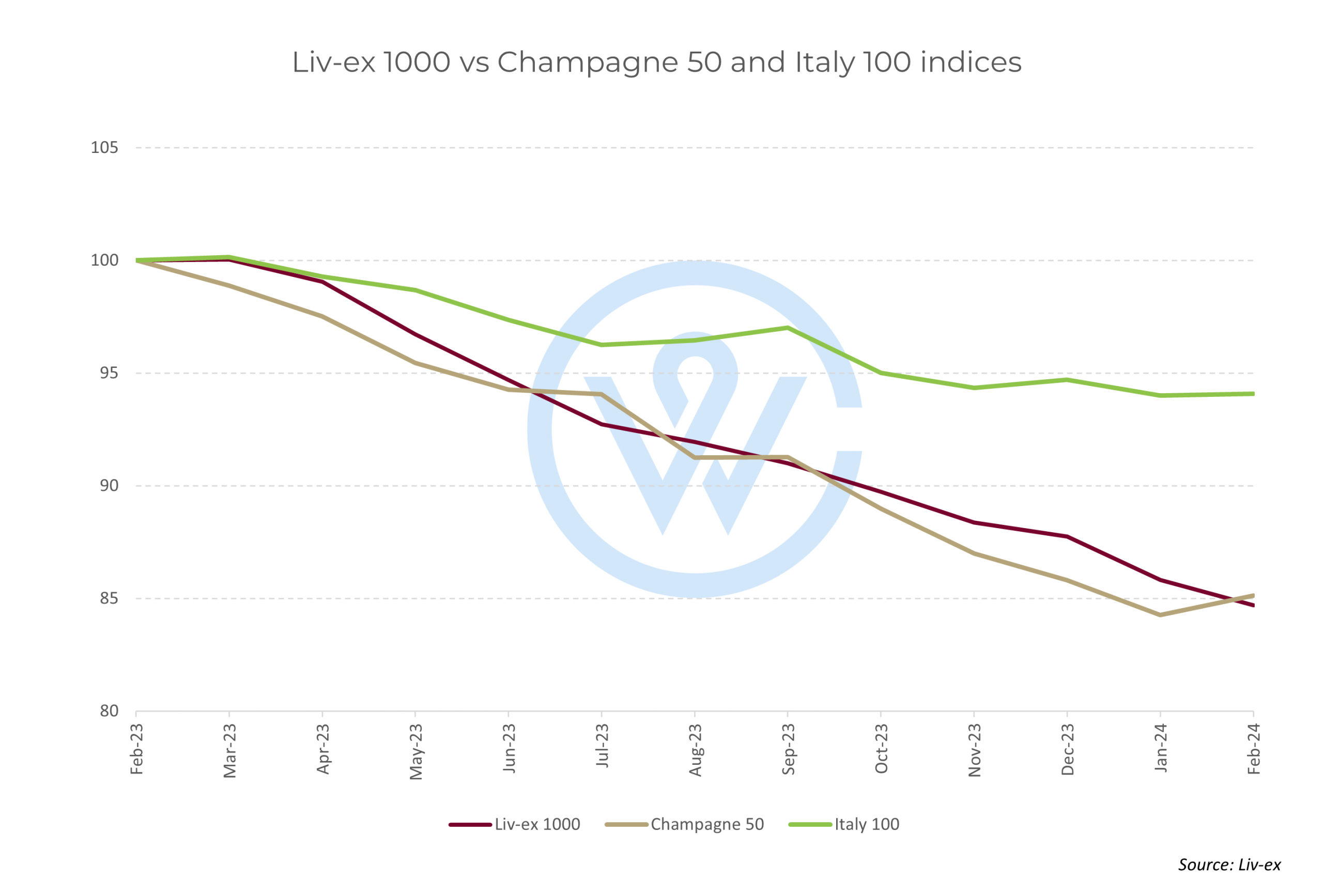

Green shoots are starting to appear in the fine wine market after a year of consistent declines. The industry benchmark, the Liv-ex 100 index, has been on a freefall since March 2023, dipping 14.6% during this time. Meanwhile, the broader Liv-ex 1000 index has fallen 15.3%.

But the market is now showing modest signs of recovery. In February, the Champagne 50 index rose for the first time in 18 months (1% MoM). The Italy 100 index also went up in December last year, and again in February amid a flurry of new releases.

Green shoots generally refer to signs of growth during a downturn. These are especially visible in regional performances.

Looking at individual wines, there are more reasons for cautious optimism. Leading brands from Bordeaux, Champagne, Burgundy, Tuscany and Piedmont have been trending upward over the last three months.

Champagne bounces back

For instance, a number of Champagnes have risen between 2% and 7% since the end of last year, including Dom Pérignon (2%), Salon Le Mesnil-sur-Oger Grand Cru (4%), Pol Roger (6%) and Veuve Clicquot La Grande Dame Rosé (7%). By contrast, many of these wines were on a downward trend six months ago. Although they have made only small gains, it looks as if tables have started to turn.

Italy’s resilient performance

This theme can also be observed in Italy. From Tuscany, Ornellaia has risen 3% in the last three months, while Antinori’s Guado Al Tasso is up 2%. Even bigger moves have been made by some Piedmont brands, like Produttori del Barbaresco Montestefano Riserva up 7%. Comm. G.B. Burlotto Barolo and Vietti Barolo Brunate have increased by 3% and 2% respectively. As examined last week, recent high-quality Italian releases have stimulated demand and secondary market activity for the region.

Bordeaux and the search for value

In Bordeaux, value has proven to be key. Popular wines beyond the First Growths and the top names have enjoyed price appreciation. These include Château Malescot St. Exupéry (3%), Château Gruaud Larose (2%) and Château La Gaffelière (2%). The average case price of these wines comfortably sits below £750.

Burgundy’s return to stability

Burgundy, which has fallen the most of all regions, also seems to be making a comeback with some high-flyers. Among them are Domaine Faiveley Gevrey-Chambertin Vieilles Vignes (12%) and Maison Louis Jadot Vosne Romanée Premier Cru Les Beaux Monts (7%).

While the general theme of the market continues to be one full of buying opportunities at cheaper-than-average prices, recent signs of growth suggest that a slow and steady recovery might soon be underway for some regions.

WineCap’s independent market analysis showcases the value of portfolio diversification and the stability offered by investing in wine. Speak to one of our wine investment experts and start building your portfolio. Schedule your free consultation today.